Spread

Spread

Definition

Most forex currency pairs are traded without commission, but the spread is one cost that applies to any trade that you place. Rather than charging a commission, all leveraged trading providers will incorporate a spread into the cost of placing a trade, as they factor in a higher asking price relative to the bid price. Its size can be influenced by different factors, such as which currency pair you are trading and how volatile it is, the size of your trade and which provider you are using.

Some of the major major forex pairs include:

- EUR/USD: Euro and US dollar

- USD/JPY: US dollar and Japanese yen

- GBP/USD: British pound and US dollar

- USD/CHF: US dollar and Swiss franc

Bid/Ask

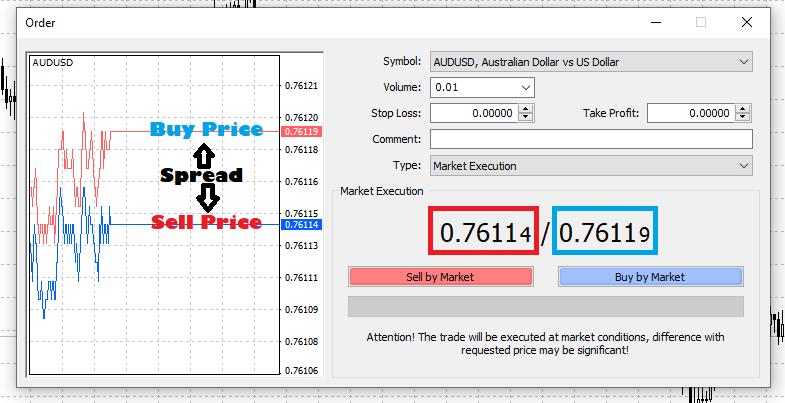

Forex brokers will quote you two different prices for a currency pair: the bid and ask price.

The “bid” is the price at which you can SELL the base currency.

The “ask” is the price at which you can BUY the base currency.

The difference between these two prices is known as the spread.

Also known as the “bid/ask spread“.

It is how “no commission” brokers make their money.

Also, it is the fee for providing transaction immediacy. This is why the terms “transaction cost” and “bid-ask spread” are used interchangeably.

Instead of charging a separate fee for making a trade, the cost is built into the buy and sell price of the currency pair you want to trade.

From a business standpoint, this makes sense. The broker provides a service and has to make money somehow.

How to calculate

The spread is calculated using the last large numbers of the buy and sell price, within a price quote. The last large number in the image below is a 3 and a 4. When trading forex, or any other asset via a CFD trading or spread betting account, you pay the entire spread upfront. This compares to the commission paid when trading share CFDs, which is paid both when entering or exiting a trade. The tighter the spread, the better value you get as a trader.

For example:

The bid price is 1.26739 and the asking price is 1.26749 for the GBP/USD currency pair.

If you subtract 1.26739 from 1.26749, that equals 0.0001.

As the spread is based on the last large number in the price quote, it equates to 1.0.