Pip

Pip

What is it?

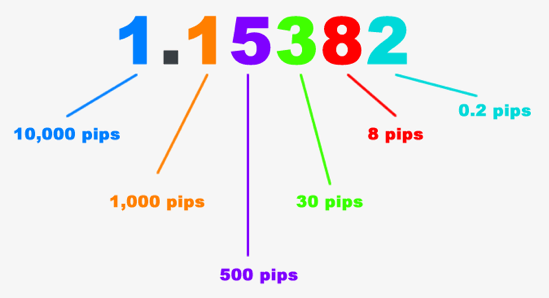

Pip is an acronym for “percentage in point” or “price interest point.” A pip is the smallest price move that an exchange rate can make based on forex market convention. Most currency pairs are priced out to four decimal places and the unit change is the last (fourth) decimal point. It is thus equivalent to 1/100 of 1% or one basis point.

If EUR/USD moves from 1.1050 to 1.1051, that .0001 USD rise in value is ONE unit.

A pip is usually the last decimal place of a price quote.

Most pairs go out to 4 decimal places, but there are some exceptions like Japanese Yen pairs (they go out to two decimal places).

For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

How to Calculate the Value of the unit?

As each currency has its relative value, it’s necessary to calculate the value of a unit for that particular currency pair.

In the following example, we will use a quote with 4 decimal places.

For better explaining the calculations, exchange rates will be expressed as a ratio (i.e., EUR/USD at 1.2500 will be written as “1 EUR / 1.2500 USD”)

Example:

Assuming a standard 100,000 lot size, and EURUSD price of 1.4000, account

denominated in USD:

- (0 0001 1 4000) 100,000 $7 14 pip for a standard lot

- ($0 74 pip for a mini lot, $0 074 pip for a micro lot)

If you are trading 3 lots, each one would be worth 3 times that amount.

Secondly, if your account is in USD, you’d be finished.

If it is in EUR or JPY, then you’d need to convert the $7.14 into that

currency.

For example, if the account is in EUR, then:

$7 14 1 4000 dollars per Euro €10 00 pip standard lot

€1 00 pip mini lot €0 1000 per micro lot

- Most currency pairs are quoted to the fourth decimal place. A pip represents the last—and thus smallest—of those four numbers.

- Even though it is a very small unit of measurement, forex traders have usually heavily leverage and even a one unit difference can equate to significant profit or loss.

- They are the most basic unit of measure in forex trading.