Equity in Forex

Equity in Forex

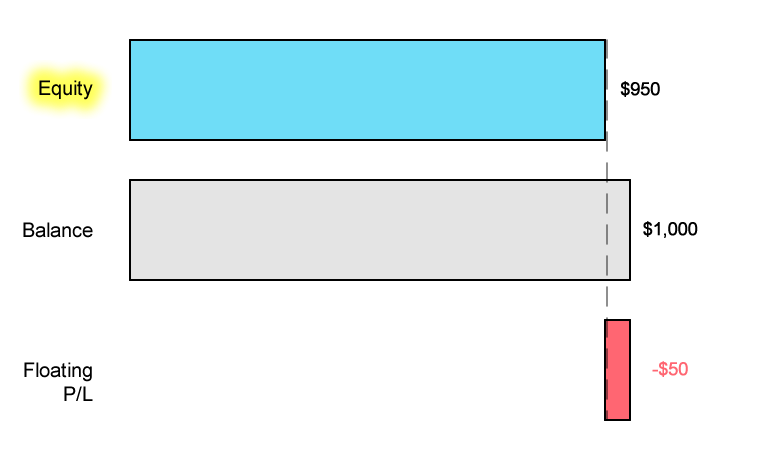

The account equity or simply “Equity” represents the current value of your trading account in forex.

Equity is the current value of the account and fluctuates with every tick when looking at your trading platform on your screen.

It is the sum of your account balance and all floating (unrealized) profits or losses associated with your open positions.

As your current trades rise or fall in value, so does your Equity.

How to Calculate Equity If You Have No Trades Open

If you do NOT have any open positions, then your Equity is the same as your Balance.

Equity = Account Balance

How Can Equity in Forex Be Applied?

It is important to make the relevance of equity even more explicit, so we will use some examples. Firstly try to take a look at the terminal window on the MetaTrader 4 platform when there are active positions in the market. The balance in the account will change solely when the trader closes their active position. What’s more, the profit/loss from such trades will be either added to or deducted from the initial account balance. Hence, the new balance will be displayed on the terminal window.

The margin can be calculated with this formula:

- Margin = (trade volume x price of the asset) / leverage.

For example, let’s assume we have 5,000 Euro in our account. We want to trade the EUR/USD currency pair, which is currently trading at 1,1400, and the leverage offered is 30: 1. For the volume of the trade, we want to trade 1 Mini-Lot (10,000 units).

- Margin = (10,000 * 1.1400)/30 = 11,400/30 = 380.00

Types of equity

The size of the company also affects the type of equities you can invest in:

- Large-cap: also known as ‘blue chip’ stocks, these are stocks from large companies. They can offer regular dividend payments and steady growth in share prices.

- Mid-cap: these are equities from medium-size companies. They are slightly riskier than large-cap, but still, pay a dividend and can have greater growth potential.

- Small-cap: small company stocks are much riskier. They don’t usually pay dividends, but if the company is successful, the share price can rise dramatically.