Basic Earnings Per Share (EPS)

Basic Earnings Per Share (EPS)

Earnings per share (EPS) is a key metric that determines the common shareholder’s portion of the company’s profit. EPS measures each common share’s profit allocation about the company’s total profit. IFRS uses the term “ordinary shares” to refer to common shares.

The EPS figure is important because it is used by investors and analysts to assess company performance, predict future earnings, and estimate the value of the company’s shares. The higher the EPS, the more profitable the company is considered to be and the more profits are available for distribution to its shareholders.

What is Basic EPS?

Basic Earnings Per Share (EPS) is a measure of profitability representing the amount of net profit allocatable to each share of common stock outstanding.

Since basic EPS denotes on a per-share basis, companies of different sizes can be compared against one another – albeit there are shortcomings that you must be aware of regarding the use of this metric.

Basic EPS Formula

The basic EPS metric refers to the total amount of net income that a company generates for each common share outstanding.

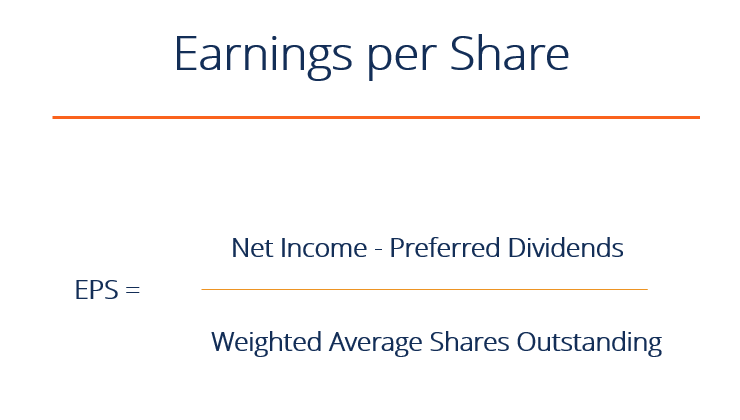

The formula for calculating basic EPS involves dividing net income by the number of common shares outstanding.

If the company has preferred dividends, we must subtract the value of the dividends paid out to preferred shareholders. This is because preferred dividends receive a “debt-like” treatment.

Impact of Basic Earnings Per Share

Stocks trade on multiples of earnings per share. So, a rise in basic EPS can cause a stock’s price to appreciate the company’s increasing earnings.

Increasing basic EPS, however, does not mean the company is generating greater earnings on a gross basis. Companies can repurchase shares, decreasing their share count as a result. They can also spread net income less preferred dividends over fewer common shares. Basic EPS could increase even if absolute earnings decrease with a falling common share count.

Another consideration for basic EPS is its deviation from diluted EPS. If the two EPS are increasingly different, it may show high potential for dilution of future common shareholders.