Index Fund

Index Fund

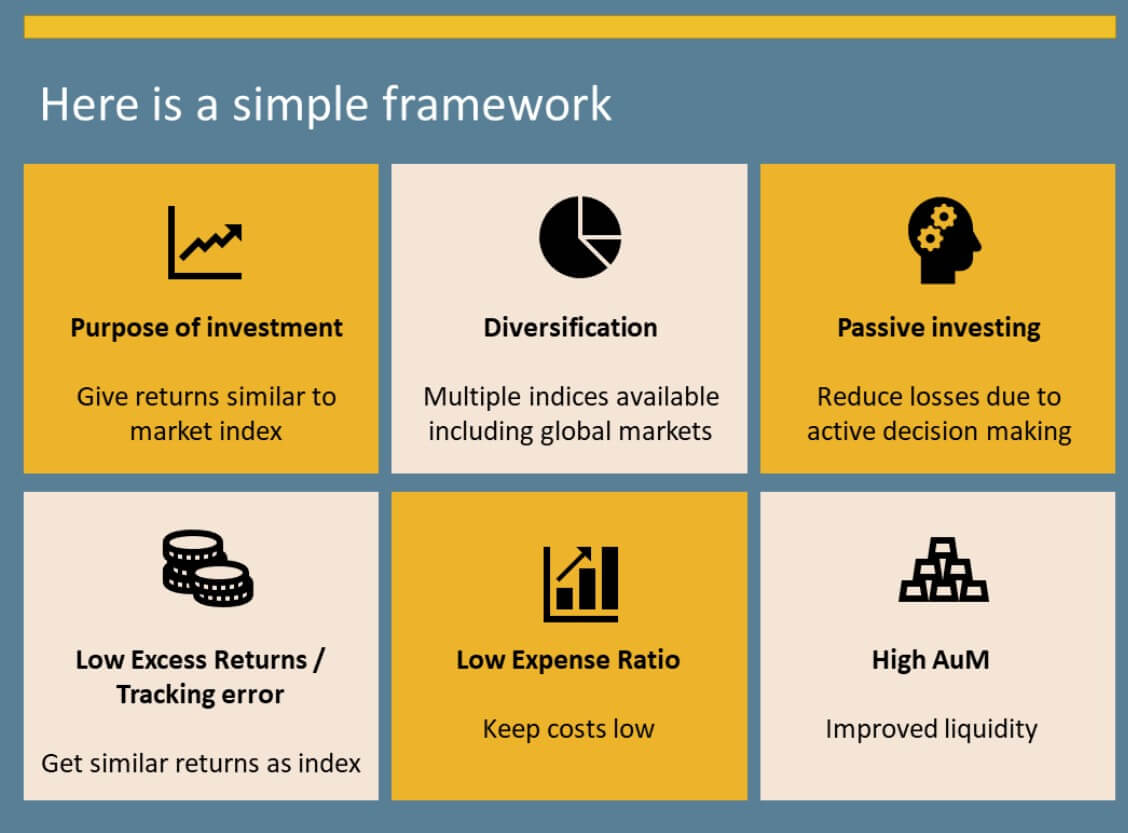

An index mutual fund or ETF (exchange-traded fund) tracks the performance of a specific market benchmark—or “index,” like the popular S&P 500 Index—as closely as possible. That’s why you may hear people refer to indexing as a “passive” investment strategy.

Instead of hand-selecting which stocks or bonds the fund will hold, the fund’s manager buys all (or a representative sample) of the stocks or bonds in the index it tracks.

Built-in benefits of index funds

Lower risk through broader diversification

Each index fund contains a preselected collection of hundreds or thousands of stocks, bonds, or sometimes both. If a single stock or bond in the collection is performing poorly, there’s a good chance that another is performing well, which helps minimize your losses.

On the other hand, when you buy individual stocks and bonds. If one goes south, your savings could take a much bigger hit in a short period.

Lower taxes

Index funds don’t change their stock or bond holdings as often as actively managed funds. Furthermore, this often results in fewer taxable capital gains distributions from the fund, which could reduce your tax bill.

Lower costs

All index funds have professional portfolio managers. What they don’t have is the need to pay more for the expertise and time it takes to hand-select stocks or bonds for each fund.

Real-World Example of Index Fund

Index funds have been around since the 1970s. The popularity of passive investing, the appeal of low fees, and a long-running bull market have combined to send them soaring in the 2010s. For 2020, according to Morningstar Research, investors poured more than $400 billion into index funds across all asset classes. For the same period, actively managed funds experienced $188 billion in outflows.

The one fund that started it all, founded by Vanguard chair John Bogle in 1976, remains one of the best for its overall long-term performance and low cost. The Vanguard 500 Index Fund has tracked the S&P 500 faithfully, in composition and performance. For its Admiral Shares, it posts an average annual return of 7.84%. Versus the index’s 7.86%, as of June 2021, for example. The expense ratio is 0.04%, and its minimum investment is $3,000.