High-Yield Bond

High-Yield Bond

High-yield bond (also called junk bonds) are bonds that pay higher interest rates because they have lower credit ratings than investment-grade bonds. They are more likely to default, so they must pay a higher yield than investment-grade bonds to compensate investors.

Issuers of high-yield debt tend to be startup companies or capital-intensive firms with high debt ratios. However, some high-yield bonds are fallen angels that lost their good credit ratings.

Non-investment grade vs investment grade

Non-investment grade ratings are those lower than BBB- (or its equivalent), while an investment grade rating (or corporate rating) is BBB- or higher.

A non-investment grade rating is important as it suggests a greater chance of an issuer’s default, wherein the company does not pay the coupon/interest due on a bond or the principal amount due at maturity promptly.

Consequently, non-investment grade debt issuers must pay a higher interest rate – and in some cases, they must make investor-friendly structural features to the bond agreement – to compensate for bondholder risk, and to attract the interest of institutional investors.

How can you invest in high-yield corporate bonds?

You can invest directly in high-yield corporate bonds by buying them from broker-dealers. Alternatively, you can invest in these high-yield bonds indirectly by buying shares in mutual funds or exchange-traded funds (ETFs) with a high-yield bond focus. These mutual funds and etFs have portfolios that contain high-yield bonds. The investment adviser of the mutual fund or ETF selects the high-yield bonds for the portfolio.

What are the risks?

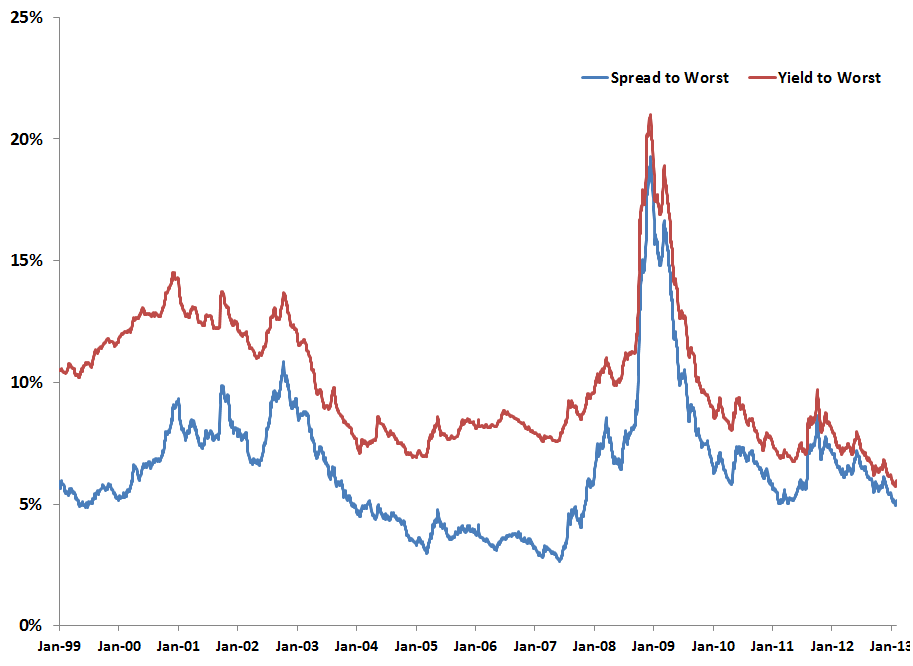

Compared to investment-grade corporate and sovereign bonds, high yield bonds are more volatile with higher default risk among underlying issuers. In times of economic stress, defaults may spike. This makes the asset class more sensitive to the economic outlook than other sectors of the bond market. High yield bonds share attributes of both fixed income and equities. Also, they can be used as part of a diversified portfolio allocation.