What Is a Breakeven Point (BEP)?

What Is a Breakeven Point (BEP)?

Breakeven Point (BEP) is the point at which your trade neither makes nor loses money.

It is also known as the price at which you have entered into a trading position.

In terms of price action, it is the level at which the risk on the trade is recovered.

For example, if you buy GBP/USD at 1.4050 and then you close the position at 1.4050 with zero profit and zero loss, you “break-even”.

Some traders like to move their initial stop-loss price to the original entry price once the current price has moved in their favour.

Stock Market Breakeven Point (BEP)

Assume an investor buys Microsoft stock at $110. If the price moves above $110, the investor is making money. If the stock drops below $110, they are losing money.

If the price stays right at $110, they are at the BEP, because they are not making or losing anything.

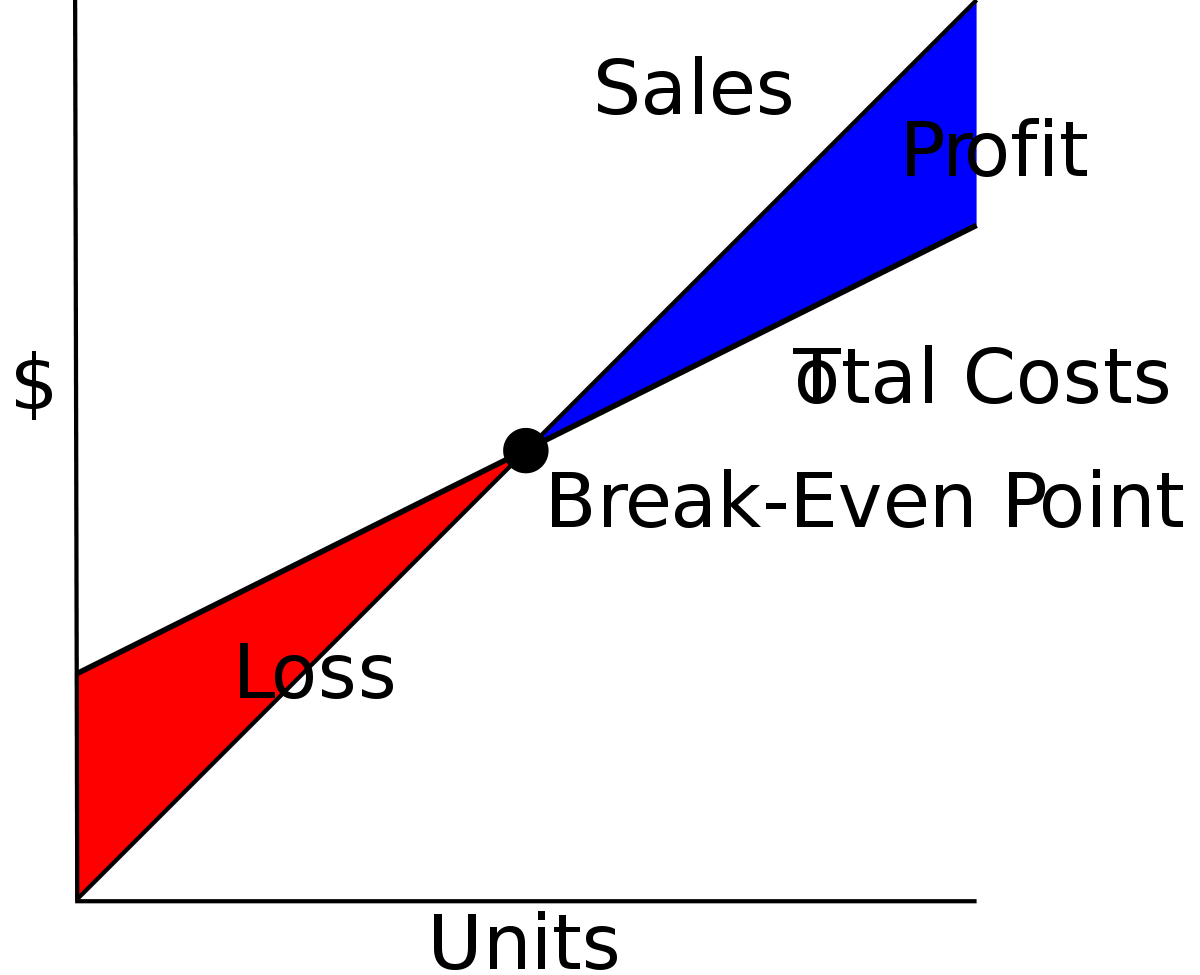

Business Breakeven Point (BEP)

The breakeven point formula for a business provides a dollar figure they need to break even. Therefore, this can convert into units calculating the contribution margin (unit sale price less variable costs). Dividing the fixed costs by the contribution margin will provide how many units break even.

The information requires to calculate a business’s BEP in its financial statements. Moreover, the first pieces of information required are the fixed costs and the gross margin percentage.

Assume a company has $1 million in fixed costs and a gross margin of 37%. Its breakeven point is $2.7 million ($1 million / 0.37). In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. Thus, if it generates more sales, the company will have a profit. If it generates fewer sales, there will be a loss.

It is also possible to calculate how many units need to be sold to cover the fixed costs, which will result in the company breaking even. To do this, calculate the contribution margin, which is the sale price of the product with fewer variable costs.

Assume a company has a $50 sale price for their product and variable costs of $10. The contribution margin is $40 ($50 – $10). Divide the fixed costs by the contribution margin to determine how many units the company has to sell: $1 million / $40 = 25,000 units. If the company sells more units than this it will show a profit. If it sells less, there will be a loss.

Example: Break-Even Price for an Options Contract

For a call option with a strike price of $100 and a premium paid of $2.50, the break-even price that the stock would have to get to is $102.50; anything above that level would be pure profit, anything below would imply a net loss.