Variation Margin

Variation Margin

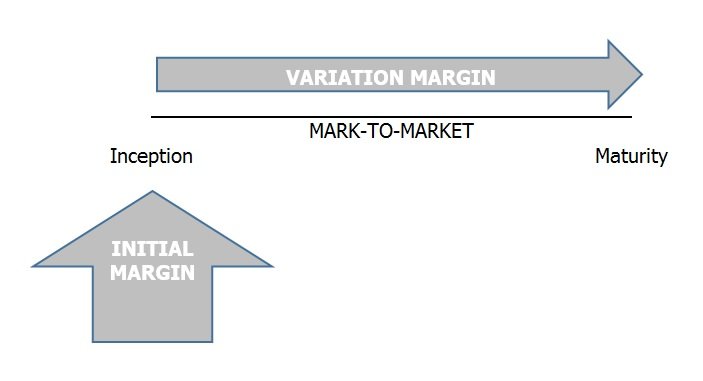

The variation margin is a variable margin payment made by clearing members, such as a futures broker, to their respective clearing houses based on adverse price movements of the futures contracts these members hold. Variation margin is paid by clearing members on a daily. Or intraday basis to reduce the exposure created by carrying high-risk positions. By demanding variation margin from their members, clearinghouses are able to maintain a suitable level of risk which allows for the orderly payment and receipt of funds for all traders using that clearinghouse.

What are Clearing Members and Clearinghouses?

A clearing member is a brokerage firm that fulfils the following criteria. It must be a member of any self-regulatory organization. Also, it must hold one or more membership in any major US stock exchange. A futures broker would be an example of a clearing member.

A clearinghouse is an intermediary organization that ensures that both parties to a transaction, i.e., the buyer and the seller, honour the obligations of a contract. A clearinghouse may act as a third party to futures contracts and options contracts, and perform several functions, such as clearing trades, settling trading accounts, reporting trading data, collecting margin monies, and regulating the delivery of freshly purchased instruments.

Example of Variation Margin

Consider a situation where a trader purchases a futures contract. On the contract, the initial margin is $5,000. The maintenance margin maybe $4,000. It means that if the total account balance falls to $4,000, the trader tops the account back up to $5,000. It is because the buffer amount in the trader’s account has been reduced to a level that is unacceptable.

The difference between the initial margin and the maintenance margin, i.e., $1,000, is the variation margin. Thus, it is the required number of funds to ensure the account reaches a minimum level to ensure future trades.