Margin Call

Margin Call

To understand a forex margin call, it is essential to know about the interrelated concepts of margin and leverage. Margin and leverage are two sides of the same coin. Margin is the minimum amount of money required to place a leveraged trade. Leverage provides traders with greater exposure to markets without having to fund the full amount of the trade.

A margin call is usually an indicator that one or more of the securities held in the account has decreased in value. When a call occurs, the investor must choose to either deposit more money in the account or sell some of the assets held in their account.

Causes

Below are the top causes for margin calls, presented in no specific order:

- Holding on to a losing trade too long depletes usable margin

- Over-leveraging your account combined with the first reason

- An underfunded account that will force you to overtrade with too little usable margin

- Trading without stops when price moves aggressively in the opposite direction.

“MarginCall Level” vs. “MarginCall”

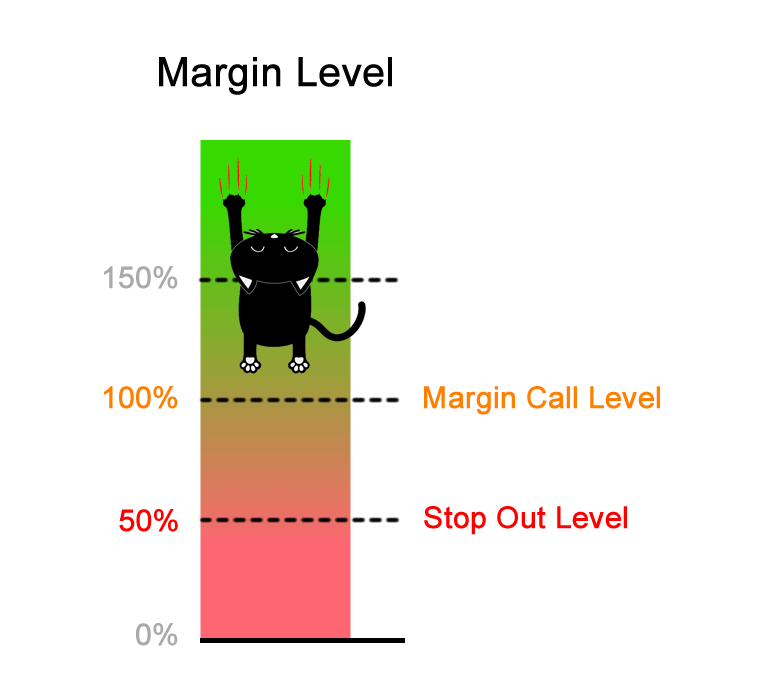

- A “Margin Call Level” is a threshold set by your broker that will trigger a “Margin Call”. It is a specific percentage (%) value of the Margin Level. For example, when the Margin Level is 100%.

- A “MarginCall” is an event. When a Call occurs, your broker takes some sort of action. Usually, the action is “to send a notification”. This event only occurs when the Margin Level falls below a certain value.

Your Margin Level is the ratio of Equity to the Margin you have in place for your open positions, calculated as:

(Equity/Used Margin) X 100 = Margin Level

The MarginCall level is the agreed minimum amount to which the Margin Level can fall before it triggers a Margin call.

Example

If a trader with a Margin Call set at 40% has $5000 as a balance but has incurred $3,800 of losses, and has used up $1,000 of Margins, his Margins Level would be: ($5,000 – $3,800) / 1000 X 100 = 120%. If his Margins Level decreased by another 80%, he would reach 40% and receive a Call.