Diluted EPS

Diluted EPS

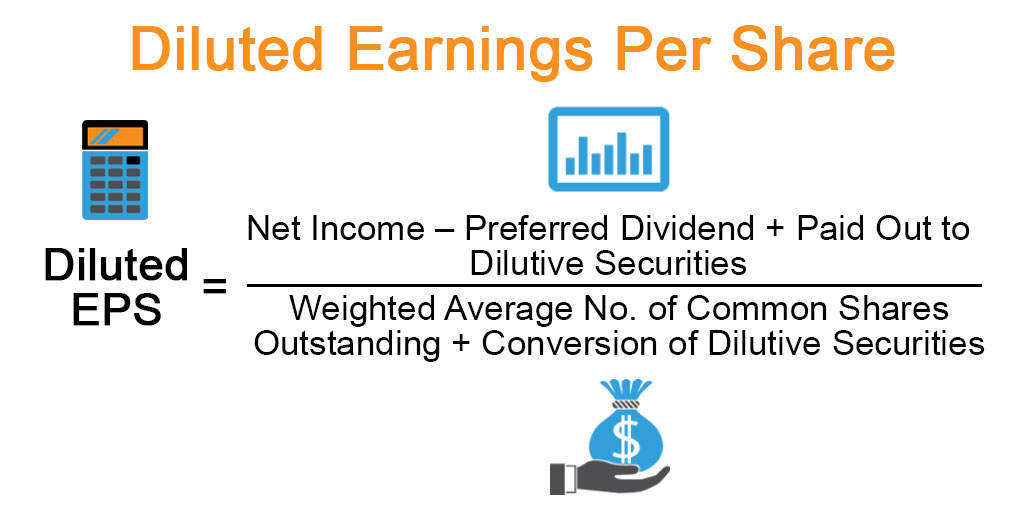

The Diluted EPS formula is equal to Net Income less preferred dividends, divided by the total number of diluted shares outstanding (basic shares outstanding plus the exercise of in-the-money options, warrants, and other dilutive securities). Also, the concept of diluted shares outstanding can be equated to a pie, of sorts. If more slices are cut to accommodate for an increase in the number of people sharing the pie, that means that the size of each slice would decrease for each additional person sharing the pie.

Diluted EPS= WASO + CDS / Net Income − Preferred Dividends

where: EPS=Earnings per share

WASO=Weighted Average Shares Outstanding

CDS=Conversion of dilutive securities

Interpreting Diluted EPS – Higher or Lower?

All else being equal, the greater the net dilutive impact from these securities, the more downward pressure there is going to be on the diluted EPS figure (and the valuation of the firm).

Generally, higher diluted EPS figures – assuming the company is mature with a track record of profitability – should obtain higher valuations from the market (i.e. investors are more willing to pay a premium for each share of equity).

In all likelihood, the company has carved out a sustainable competitive advantage (i.e. “edge”) and is a market leader – i.e. holds a substantial percentage of the total market share.

If that presumption is true, the longevity of the company is likely optimistic. Therefore, the company has greater flexibility in terms of:

- Raising Prices on Products / Services (i.e. Pricing Power)

- Funding Expansion Plans with Excess Cash

- Extending Payables with Suppliers

- Diversification of Revenue Sources

- Acquiring Smaller-Sized Competitors

Example of Diluted Earnings per Share

Convertible preferred stock, stock options, and convertible bonds are common types of dilutive securities. Also, convertible stock is a share that can convert to a common share at any time. Therefore, Stock options, a common employee benefit, grant the buyer the right to purchase common stock at a set price at a set time.

Convertible bonds are similar to convertible stock as they convert to common shares at the prices and times specified in their contracts. Moreover, all of these securities, if exercised, would increase the number of shares outstanding and decrease EPS.