Basis Risk

Basis Risk

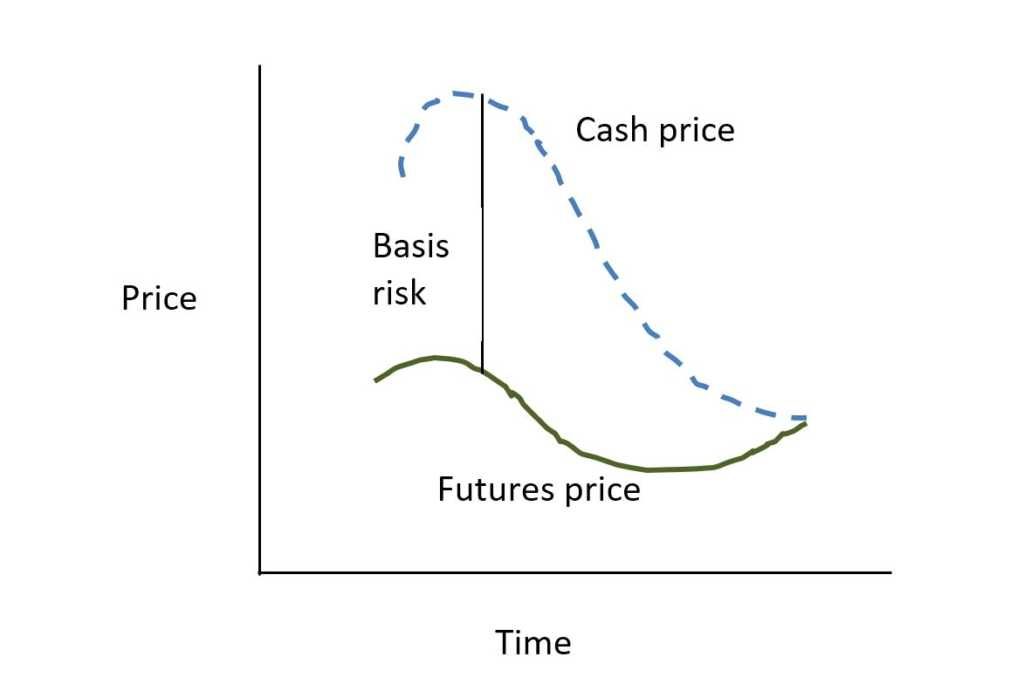

Basis risk is the inherent risk a trader takes when hedging a position by taking a contrary position in a derivative of the asset, such as a futures contract. It is normal in an attempt to hedge away price risk.

As an example, if the current spot price of gold is $1190 and the price of gold in the June gold futures contract is $1195. Then the basis, the differential, is $5.00. Basis risk is the risk of not moving futures price in a steady correlation with the price of the asset. Also, that this fluctuation in the basis may negate the effectiveness of a hedging strategy employed to minimize a trader’s exposure to potential loss. The price spread (difference) between the cash price and the futures price may either widen or narrow.

Basis Risk Management

The formula for calculating basis is:

Basis = Cash/Spot Price – Futures Price

This is dependent on time, location and quality. Every town, every farmer, every quality has its basis. When you use the futures price to manage your risk, you assume that the futures price will move. More or less like the price of your physical product in the market where you plan to sell it.

If you are a farmer harvesting in September and you sell October futures for 500USD/ton, and your “normal” basis is -50USD. Then, you expect to realize a price of 450 USD per ton, irrespective of what happens in the market.

If the market falls by USD by September, you will sell your physical product for only 350 USD/ton. However, you expect this will be compensated by a profit of 100 USD/ton in your futures contract. (you buy back the futures contracts that you had sold at 500 USD/ton at 400 USD/ton). But that is only when the basis remains stable…

But in practice, each physical market is specific, and you run a basic risk. Generally speaking, basis risk is the result of an imperfect correlation between the asset to be hedged and the asset used for hedging. It is the risk that the fluctuation in the basis may negate the effectiveness of a hedging strategy, exposing the hedger to unexpected losses.