Vertical analysis

Vertical analysis

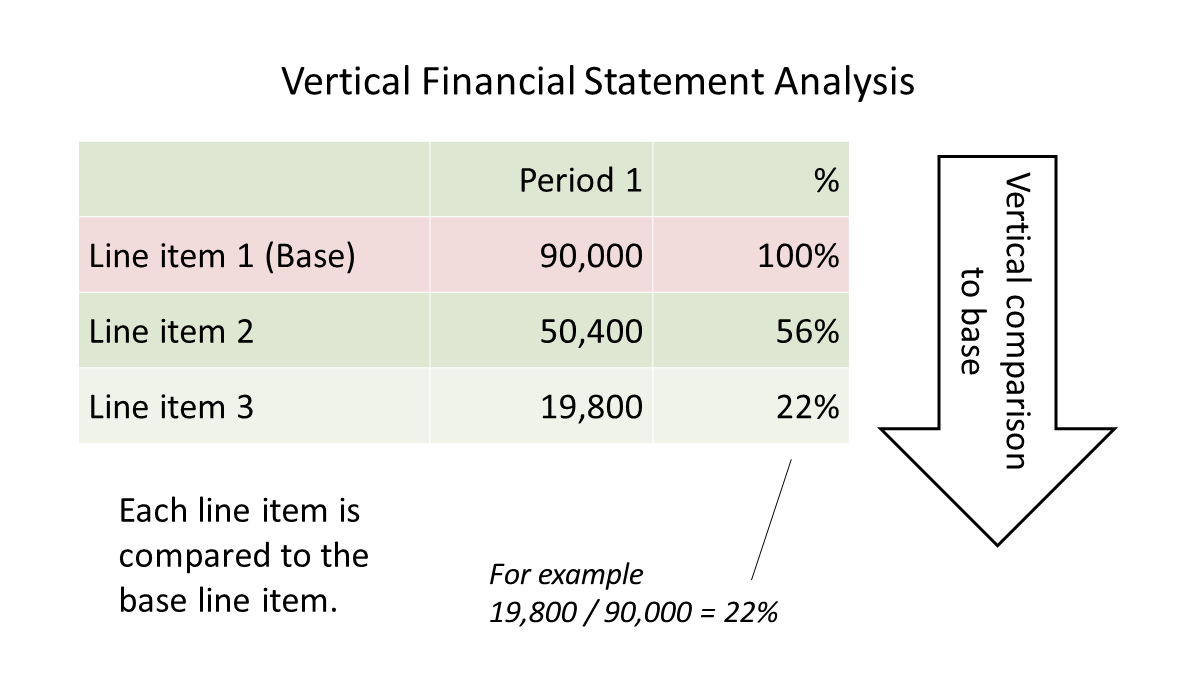

Vertical analysis is the proportional analysis of a financial statement, where each line item on a financial statement lists as a percentage of another item. It is also useful for trend analysis, to see relative changes in accounts over time, such as on a comparative basis over five years. For example, if the cost of goods sold has a history of being 40% of sales in each of the past four years, then a new percentage of 48% would be a cause for alarm.

When is Vertical Analysis Used?

Vertical analysis is most common within a financial statement for a single reporting period, e.g., quarterly. The accountants can ascertain the relative proportions of the balances of each account.

It is exceptionally useful while charting a regression analysis or a ratio trend analysis. It enables the accountant to see relative changes in company accounts over a given period. The analysis is especially convenient to do so on a comparative basis.

Vertical Analysis – Formula

To calculate the percentage, concerning the income statement and the balance sheet, the formulas are:

Vertical Analysis

-(Income Statement) = Item in Income Statement/Total Sales * 100

– (Balance Sheet Statement) = Item in Balance Sheet/Total Assets * 100

Deeper composition insights: the analysis enables the analyst to delve deeper into a financial statement and better comprehend its composition. To perform such analysis, one needs to create a common size financial statement (for example, a common size income statement).

Advantages and example

Key trend: vertical analysis of financial statements is also very useful in analyzing key trends over time. For example, we can assess the changes in the working capital or fixed assets (items in the balance sheet) over time.

For example, by showing the various expense line items in the income statement as a percentage of sales, one can see how these are contributing to profit margins and whether profitability is improving over time. It thus becomes easier to compare the profitability of a company with its peers.