Variable Cost

Variable Cost

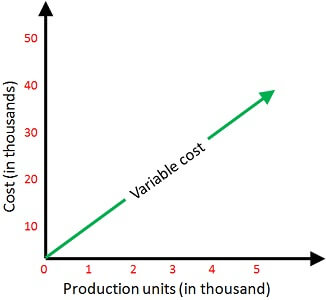

A variable cost is a corporate expense that changes in proportion to how much a company produces or sells. Variable costs increase or decrease depending on a company’s production or sales volume—they rise as production increases and fall as production decreases.

Examples of variable costs include a manufacturing company’s costs of raw materials and packaging—or a retail company’s credit card transaction fees or shipping expenses, which rise or fall with sales. A variable cost can contrast with a fixed cost.

The Most Common Variable Costs

- Direct materials

- Direct labour

- Transaction fees

- Commissions

- Utility costs

- Billable labour

Essentially, if a cost varies depending on the volume of activity, it is a variable.

Formula

Total Variable Cost = Total Quantity of Output x Variable Cost Per Unit of Output

Variable costs are a company’s costs that associate with the number of goods or services it produces. A company’s variable costs increase and decrease with its production volume. When production volume goes up, the variable costs will increase. On the other hand, if the volume goes down, so too will the variable costs.

Variable costs are generally different between industries. Therefore, it’s not useful to compare the variable costs of a car manufacturer and an appliance manufacturer, for example, because their product output isn’t comparable. So it’s better to compare the variable costs between two businesses that operate in the same industry, such as two car manufacturers.

Example

Firstly, you may calculate the costs by multiplying the quantity of output by the variable cost per unit of output. This calculation is simple and does not take into account any other costs such as labor or raw materials.

Suppose company ABC produces ceramic mugs for a cost of $2 a mug. If the company produces 500 units, its cost is $1,000. However, if the company does not produce any units, it will not have any variable costs for producing the mugs. Similarly, if the company produces 1000 units, the cost will rise to $2,000.