Pivot

Pivot

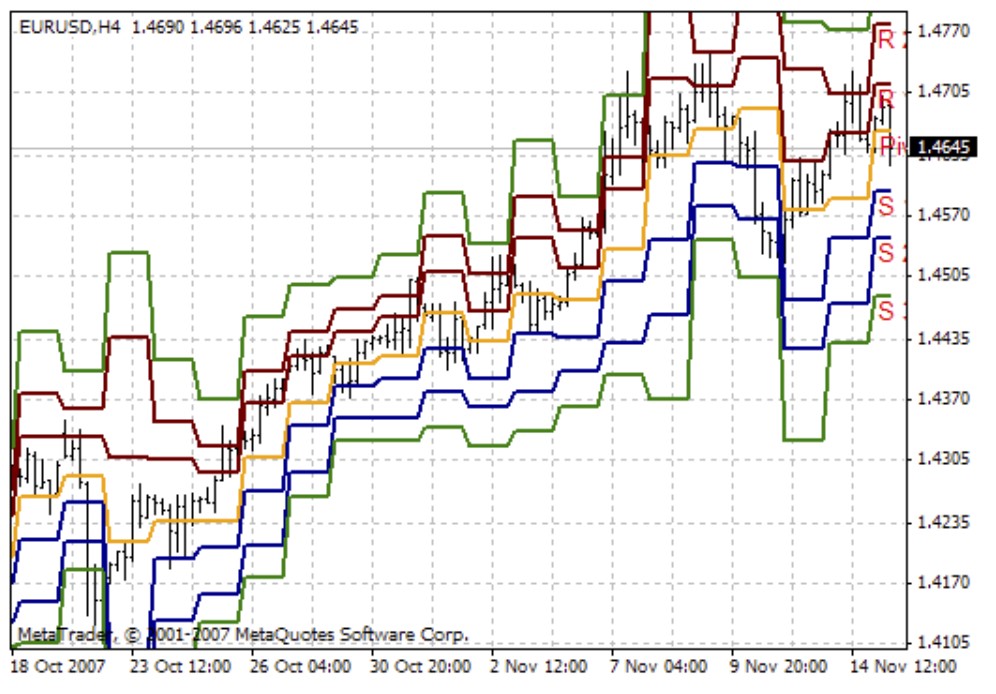

Pivot Point is a turning point for the direction of price movement in a market. Pivot Points can be used on all liquid markets with stable price ranges. Pivot Points work very well on the futures markets and on the Forex.

During trends price tends to go from a Pivot level to the first or second support or resistance levels. The area of the second support/resistance is often treated as the target of price movement.

Prices often move from the first support to resistance within a range, while Pivot acts as the axis for price rotation.

One of the problems of stock trading is that the trader needs some base to enter a deal. It is important to find a starting point, i.e. a place where the market can turn, where it can adjust and what level it can reach. Pivot Point associated support and resistance levels can help a trader in solving these problems with high probability.

Of course, the price may behave differently. It often breaks through these levels, then turns around, sometimes it does not reach the level and turns – such is the nature of the market. It is prone to false movements and breakthroughs. Nevertheless Pivot Points have proved their efficiency and are widely used by traders.