Kagi Charts

Kagi Charts

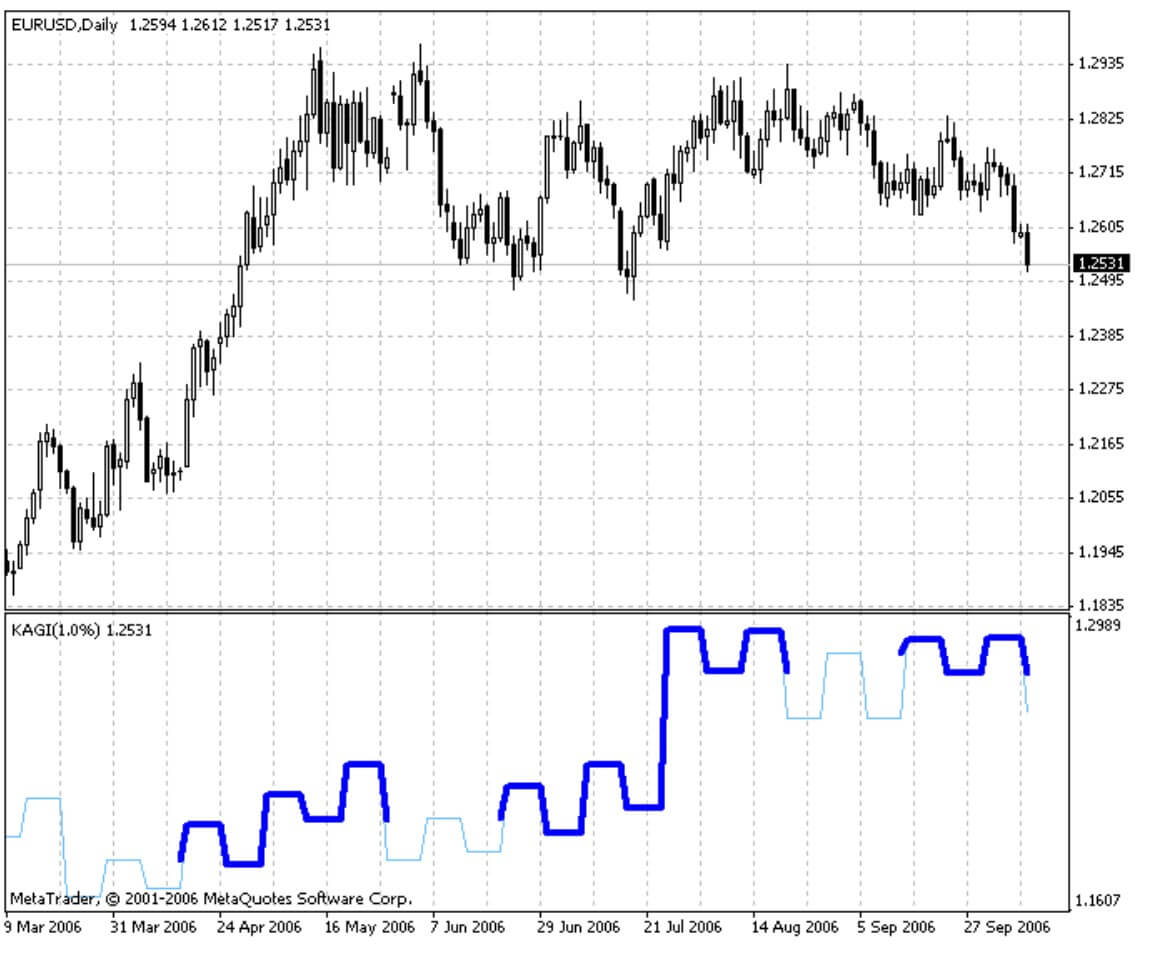

The Kagi Charts are supposed to appear in 70s of the 20th century, at the first stage of Japanese stock market development. The Kagi Charts represent a series of interconnected vertical lines. The thickness and increment direction of these lines are determined by the price dynamics. The Kagi Charts do not consider the time.

If price move on in the same direction, the vertical line in the chart becomes longer. If the price turns by a pre-defined value (reverse coefficient), a new vertical line in a new column will be drawn in the chart. The thickness of Kagi lines changes when prices exceed their previous maximum/minimum values.

The Kagi Charts became known in the USA due to Steve Nison’s book named “Beyond Candlesticks”.

The Kagi Charts illustrate how demand-and-supply forces act. A sequence of thick lines speaks for that the demand is above supply (the market grows).

A sequence of thin lines means that the supply is above demand (the market drops). Interchange of thick and thin lines speaks for that the market is balanced (supply is equal to demand).

The basic trade signal on a Kagi chart is the line thickness: If a thin line becomes thick, you should buy, if vice versa, you should sell.

A sequence of increasing maximums and minimums speaks for the power of the ascending movement, decreasing maximums and minimums speak for the weak market.

Parameters

Porog – reversing coefficient in percents