Indicator of Volatility Change

Indicator of Volatility Change

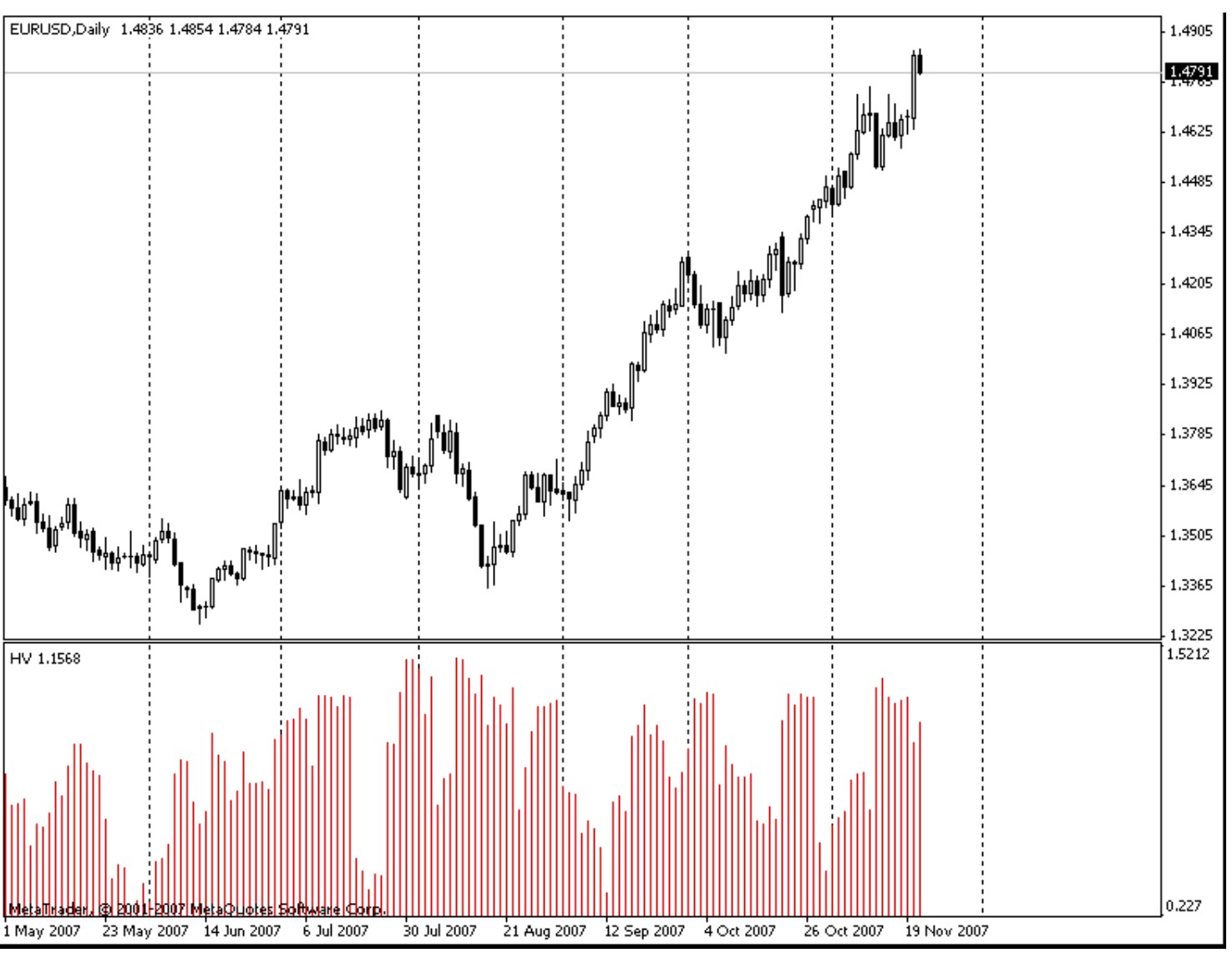

There are a lot of ways to measure volatility (changeability). One of them is calculation of the standard deviation of returns for a certain period of time. Sometimes the current volatility on a short period of time (for example, 6 days) is correlated with volatility of a larger period (for example 100 days). This indicator calculates the correlation of a short volatility Vol_short and a long volatility Vol_long.

Vol_change=Vol_short/Vol_long |

|---|

Standard deviation here is not that from a difference of closing prices, but from logarithms of the correlation of the current day closing price and closing price of a previous day: Mom[i]=Close[i]/Close[i+1].

Vol_k=Std(Mom,k),

where k is the period of volatility change.