Bid vs Ask Price

Bid vs Ask Price

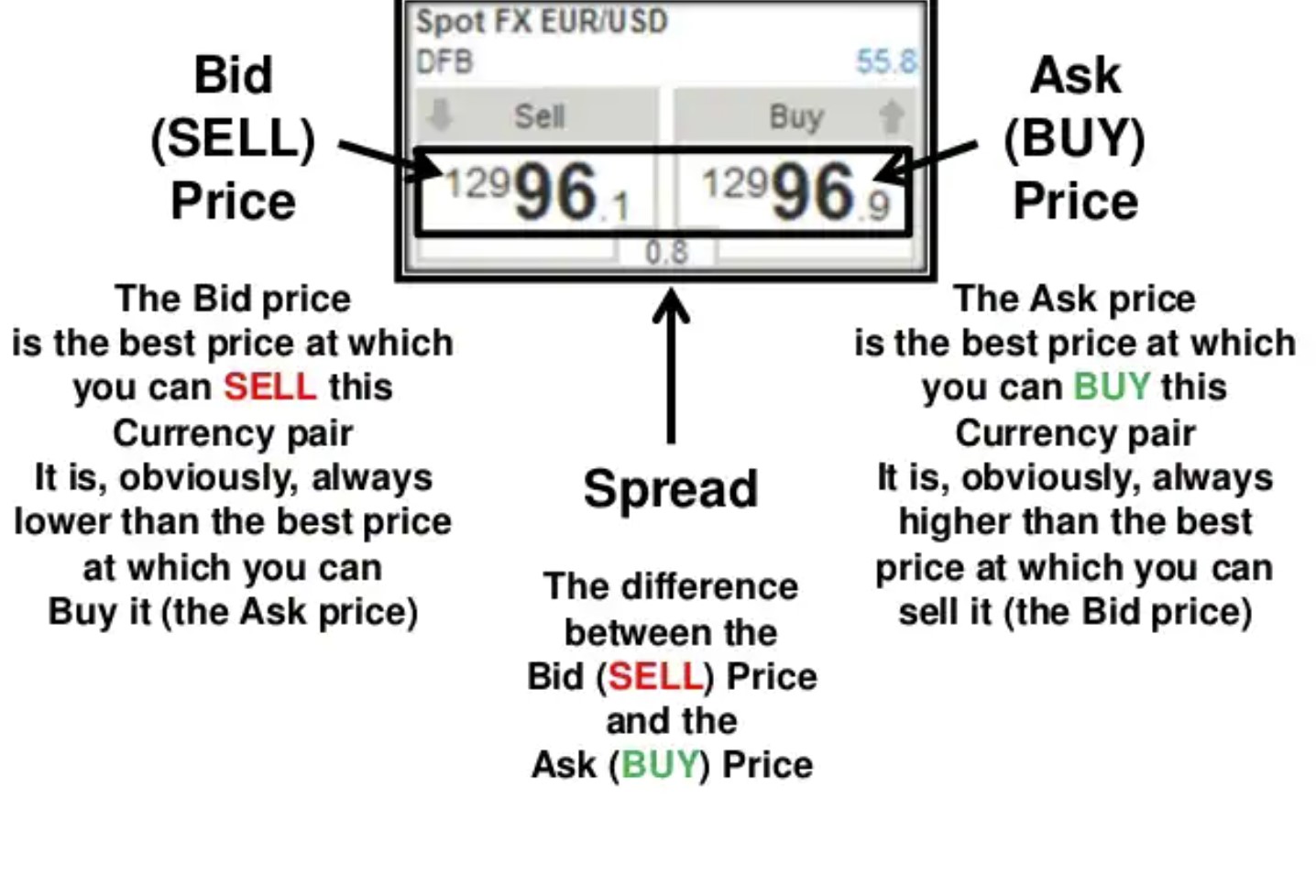

The Bid price is the price a forex trader is willing to sell a currency pair for. Ask price is the price a trader will buy a currency pair at. Both of these prices are given in real-time and are constantly updated. So for example, the British pound against the US dollar has a bid price of 1.20720, that’s the price a trader wants to sell the GBPUSD. A seller who thinks a currency will decline might sell at the bid price to take advantage of the fall. If the British pound against the US dollar has an asking price of 1.20740, that’s the price a trader wants to pay to buy the currency pair. The difference between the ask and the bid price is the spread.

Understanding Bid and Ask

The average investor contends with the bid and ask spread as an implied cost of trading. For example, if the current price quotation for the stock of ABC Corp. is $10.50 / $10.55, investor X, who is looking to buy A at the current market price, would pay $10.55, while investor Y, who wishes to sell ABC shares at the current market price, would receive $10.50.

Who Benefits from the Bid-Ask Spread?

The bid-ask spread works to the advantage of the market maker. Continuing with the above example, a market maker who is quoting a price of $10.50 / $10.55 for ABC stock is indicating a willingness to buy A at $10.50 (the bid price) and sell it at $10.55 (the asked price). The spread represents the market maker’s profit.

Bid-ask spreads can vary widely, depending on the security and the market. Blue-chip companies that constitute the Dow Jones Industrial Average may have a bid-ask spread of only a few cents, while a small-cap stock that trades less than 10,000 shares a day may have a bid-ask spread of 50 cents or more.

The bid-ask spread can widen dramatically during periods of illiquidity or market turmoil. Since traders will not be willing to pay a price beyond a certain threshold. And sellers may not be willing to accept prices below a certain level.

Differences

As the current price represents the market value of a financial instrument, the bid vs asks prices represents the maximum buying and minimum selling price respectively.

- The bid price is defined as the maximum price that a buyer is willing to pay for a financial instrument.

- The asking price is defined as the minimum price that a seller is willing to accept for the instrument.