Forex Leverage

Forex Leverage

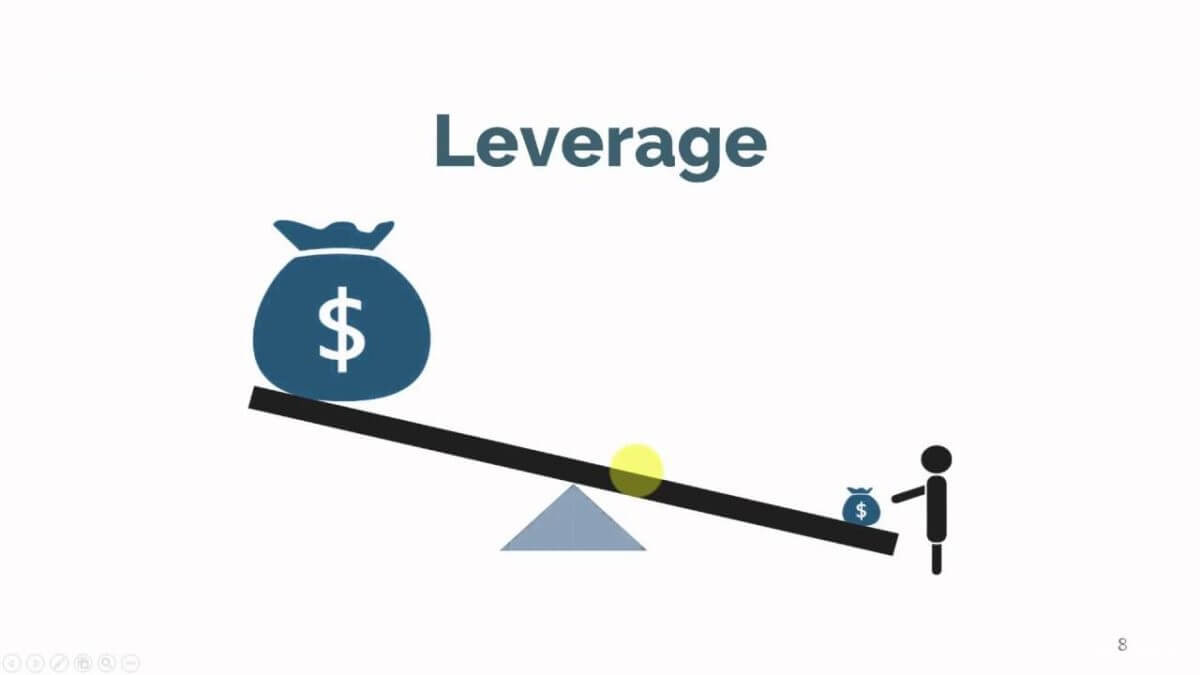

Leverage involves borrowing a certain amount of the money needed to invest in something. In the case of forex, money is usually borrowed from a broker. Forex trading does offer high leverage in the sense that for an initial margin requirement, a trader can build up—and control—a huge amount of money.

What is Leverage Ratio?

Leverage on Forex is the number of trading funds that the broker is willing to lend to your investment based on the ratio of your capital to the number of credit funds.

The total amount of leverage provided by the broker is not constant. Brokers set their rates, which in some cases can reach 1:100 or even more. Forex leverage is mostly expressed as a ratio. In this example, it means that with the equity of $1, you can open positions for up to $100.

Benefits of leverage use

Firstly, let’s take a look at the benefits of leverage for a novice trader:

1. Chance of making super high profits

Therefore, using leverage on Forex allows traders to increase their initial investment to play big. How to start your trading process, you can find out here.

2. Improving capital efficiency

For example, if your account balance is $1000 and you use a leverage of 1:100, you will have 100,000 USD to manage. This means you have the opportunity to open more trades in various trading instruments and apply hedging techniques for additional protection against risks. This allows you to diversify your portfolio, reduce risks, and increase the chances of making a profit.

3. Low entry level

Let’s look at this advantage using the previous example – you have 1,000 dollars on your account. Let’s say that you don’t use leverage, i.e. you trade 1:1.

4. Favorable financial conditions

Before, when brokers provided no leverage, the only opportunity to trade with leverage was borrowing a very limited amount of funds from the Bank at high interest rates, huge collaterals and guarantees.

The deposit growth of the high-risk traders can easily reach up to 300-500% profitability per month, which is much higher than in any bank.

5. Convenience

You have to remember that leverage will maximise profits from successful trades to the same degree it will multiply your losses should the trade not go well.

So when making trades using leverage, you must be careful with taking risks as that can set you back.