Technical analysis

Technical analysis

Technical analysis is the framework in which traders study price movement.

Foreign exchange markets are particularly well suited to using technical analysis. The high levels of liquidity in terms of trading volumes and some players, and sensitivity to big long-term national-level trends means that forex markets tend to trend over time and patterns often have the chance to fully develop.

At the same time, technical analysis in forex markets can also be used effectively in developing and executing short-term trading strategies.

Forex chart patterns

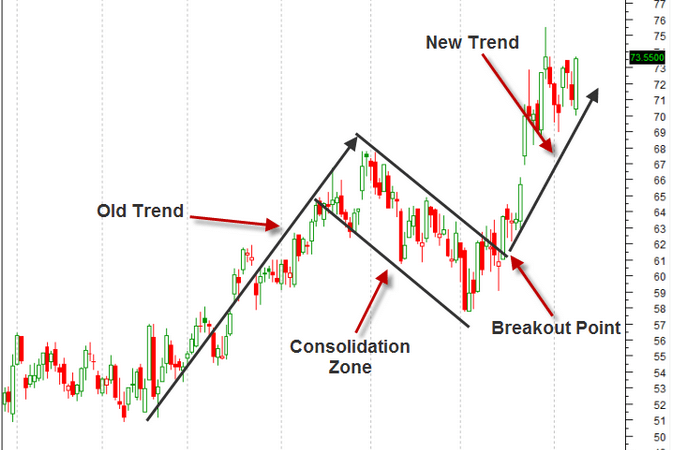

Traders in forex markets can use many of the same western analysis techniques as other markets, including patterns like wedges, triangles, channels, double tops and bottoms and head and shoulders. Quantitative and combination techniques like moving averages, Bollinger Bands® and Fibonacci retracements are also popular, along with analysis of oscillators and momentum indicators like MACD, RSI and stochastics. Wedge patterns and Bollinger Bands are examples of two of the most popular technical analysis methods.

Forex candlestick patterns

Forex traders also can use eastern analysis techniques like candlestick patterns, particularly for short-term term trading and identifying key turning points. Some of the popular candle patterns include dojis, hammers, hanging men, morning and evening stars and engulfing candles.

Many forex traders find using a combination of analysis techniques particularly helpful. As the more indicators that align to suggest a potential trade, the higher the confidence level.

Underlying Assumptions of Technical Analysis

- Markets are efficient with values representing factors that influence a security’s price, but

- Even random market price movements appear to move in identifiable patterns and trends that tend to repeat over time.

Technical vs. Fundamental Analysis

Fundamental and technical analyses are at opposite ends of the spectrum. Both methods do research and forecast future trends in stock prices. Also, like any investment strategy or philosophy, both have their advocates and adversaries.