Volume Divergence Markers (VDM)

Volume Divergence Markers (VDM)

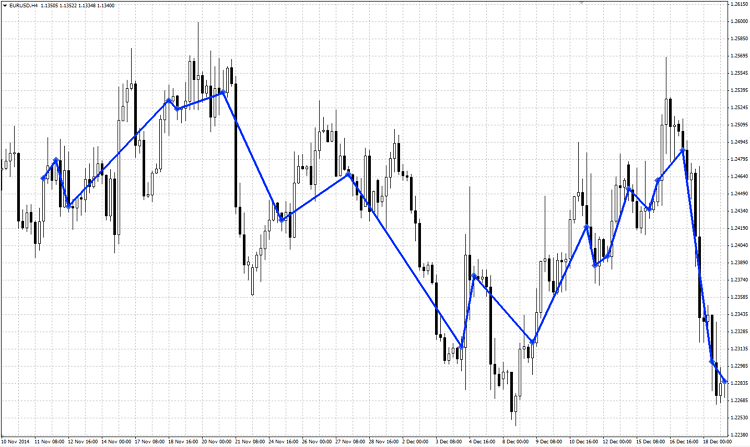

This indicator places a marker on a chart based on a divergence between trade volumes and bar sizes, i.e. if bar size has been decreasing/increasing for N continuous bars and volume has been doing the opposite, a marker will be placed.

Usually, the markers are placed near the peaks before a reverse or in the middle of a technical correction during a trend. This indicator can be used to identify potential entry or exit points, depending on the configuration of input parameters. VDM does not provide complete information about potential trades if used without other indicators.

Higher input variables values mean less frequent signals. I am currently experimenting on how the false signals can be filtered. Also, a complementary indicator, which shows the direction in which the positions should be opened, is currently in development. Feel free to post your suggestions about improving this indicator.

Input variables:

- Whether or not zero bar should be counted.

- Convergence or divergence switch (convergence creates markers if both volume and bar sizes are moving in the same direction; divergence – in the opposite).

- How long the volume has to increase/decrease to trigger the marker (in bars).

- How long the bar size has to increase/decrease to trigger the marker (in bars).

Recommendations:

- The purpose of this indicator is to maximise profits by opening/closing trades at optimal entry/exit points.

- The optimal values for input variables are somewhere between 1-3 bars. Values above 4 are pointless because it never happens on a market.

- Works best during flat price movements.

- IMPORTANT! Do not use this indicator on its own to open any trades because it doesn’t show the direction of price movement.