Horizontal Analysis

Horizontal Analysis

Horizontal analysis is an approach used to analyze financial statements by comparing specific financial information for a certain accounting period with information from other periods. Analysts use such an approach to analyze historical trends.

Horizontal analysis can also be compared with a vertical one. Whereas vertical analysis analyzes a particular financial statement using only one base financial statement of the reporting period. The horizontal one compares a specific financial statement with other periods or the cross-sectional of a company against another company.

The Formula

First, we need to take the previous year as the base year and last year as the comparison year. For example, let’s say we are comparing between 2015 and 2016; we will take 2015 as the base year and 2016 as the comparison year.

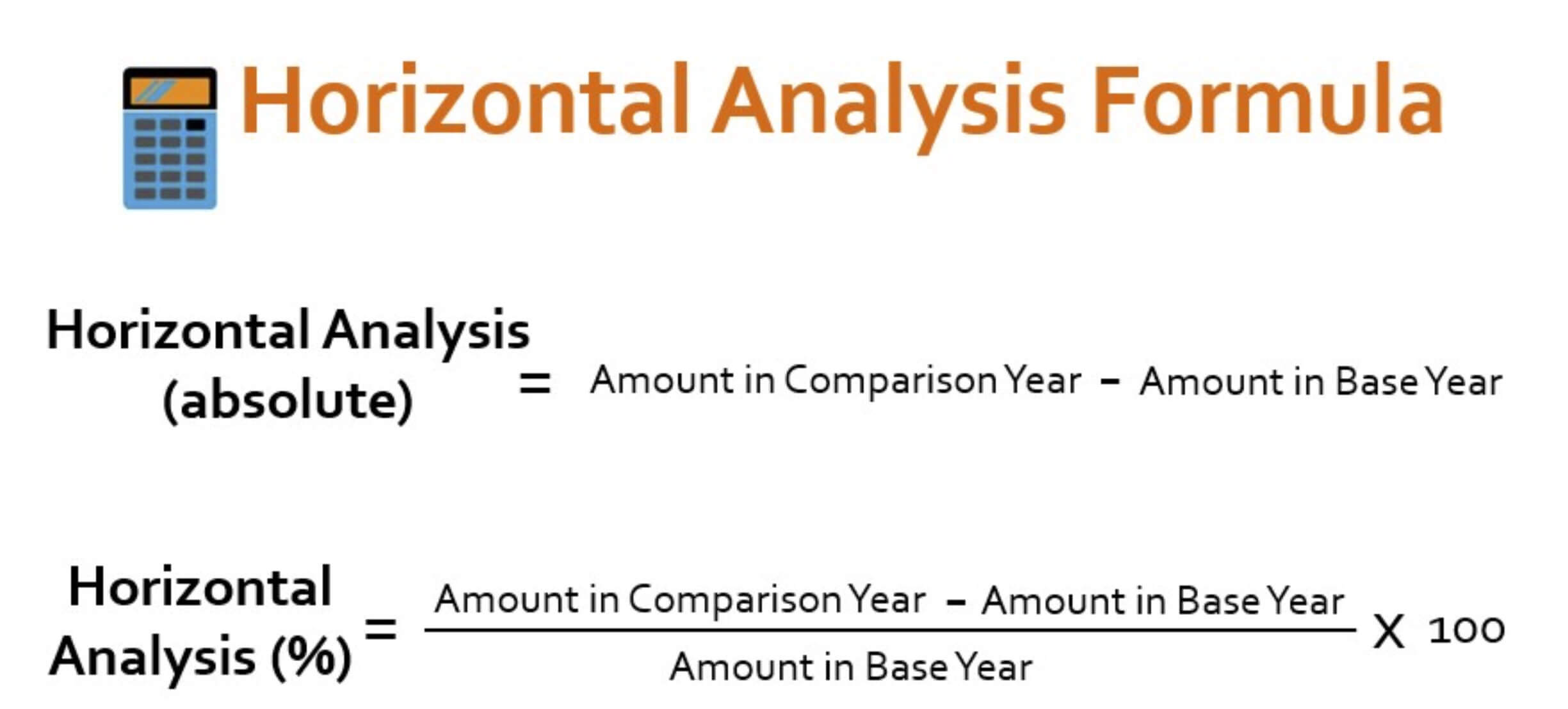

Horizontal Analysis formula = [(Amount in comparison year – Amount in the base year)/ Amount in a base year] x 100

Criticism of Horizontal Analysis

Depending on which accounting period an analyst starts from and how many accounting periods choose. Therefore, the current period can appear unusually good or bad. For example, the current period’s profits may appear excellent when only compared with those of the previous quarter. However, they are quite poor if comparing to the results for the same quarter in the preceding year.

A common problem with the analysis is that the aggregation of information in the financial statements may have changed over time. So that revenues, expenses, assets, or liabilities may shift between different accounts and, therefore, appear to cause variances when comparing account balances from one period to the next. Indeed, sometimes companies change the way they break down their business segments to analyze growth and profitability trends more difficult to detect. Accurate analysis can affect one-off events and accounting charges.

Second formula

Horizontal Analysis (%) = [(Amount in Comparison Year – Amount in Base Year) / Amount in Base Year] * 100

How Can an Investor Use Horizontal Analysis?

Investors can use the analysis to determine the trends in a company’s financial position and performance over time to determine whether they want to invest in that company. However, investors should combine horizontal with vertical and other techniques to get a true picture of a company’s financial health and trajectory.