High-Low Method

High-Low Method

In cost accounting, the high-low method is a way of attempting to separate fixed and variable costs given a limited amount of data. Thus, the high-low method involves taking the highest level of activity and the lowest level of activity and comparing the total costs at each level.

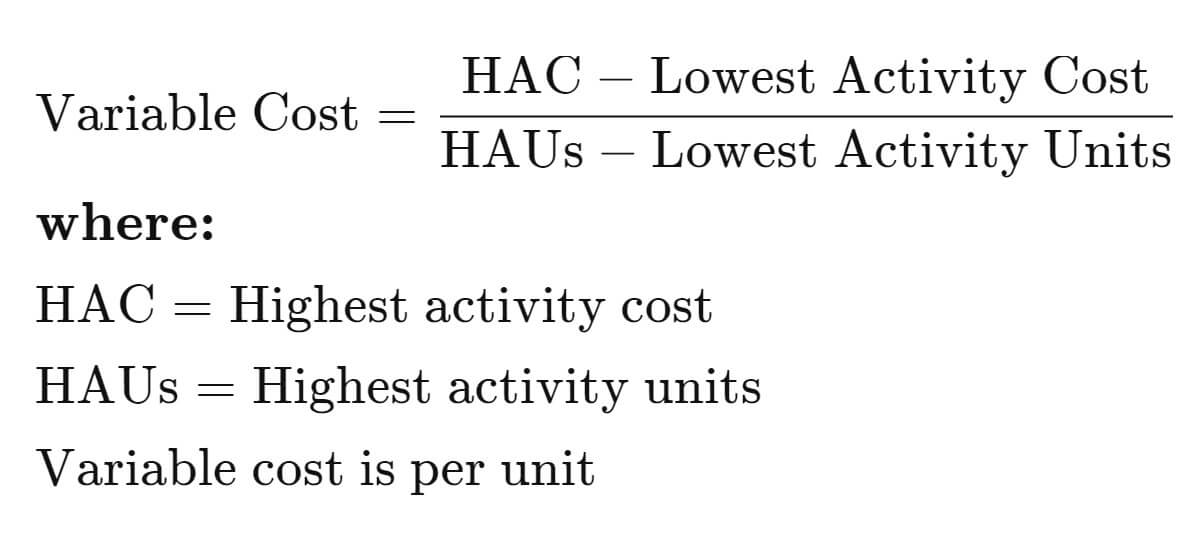

Formula

Once the variable cost per unit is:

Fixed cost = Highest activity cost – (Variable cost per unit x Highest activity units)

or

Fixed cost = Lowest activity cost – (Variable cost per unit x Lowest activity units)

The resulting cost model after using the high-low method would be as follows:

Cost model = Fixed cost + Variable cost x Unit activity

High-low method example

Bonnie runs a small car factory in Detroit and needs to know the expected amount of overheads the factory will incur in the next month.

Firstly, Bonnie expects to produce 8,000 units in May.

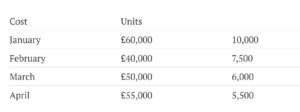

Step 1: Identify the highest and lowest activity level

The highest activity level is 10,000 units in January (highest activity is £60,000)

The lowest activity level is 5,500 units in April (lowest activity is £55,000)

Step 2: Calculate the variable cost per unit

Then, you use the formula shown above to work it out:

Variable cost per unit = (£60,000 − £55,000) ÷ (10,000 − 5,500)

Variable cost per unit = £5,000 ÷ 4,500 = £1.11 per unit

Step 3: Calculate the fixed cost

Also, you use the formula shown above to work it out:

Fixed cost = £60,000 − (£1.11 x 10,00) = £48,900

Step 4: Calculate the total variable cost for the new activity

Then, you multiply the variable cost per unit (step 2) by the number of units expected production in May to work out the total variable cost for the month.

Total variable cost = £1.11 x 8,000 = £8,880

Step 5: Calculate the total cost

Furthermore, you add the fixed cost (step 3) and variable cost for the new activity (step 4) together to get the total cost of overheads for May.

Total cost = £48,900 + £8,880 = £57,780

What Does the High-Low Method Tell You?

The costs associated with a product, product line, equipment, store, geographic sales region, or subsidiary, consist of both variable costs and fixed costs. Therefore, to determine both cost components of the total cost, an analyst or accountant can use a technique known as the high-low method.

The high-low method calculates the variable and fixed cost of a product or entity with mixed costs. It considers two factors. Moreover, it considers the total dollars of the mixed costs at the highest volume of activity and the total dollars of the mixed costs at the lowest volume of activity. Therefore, the total amount of fixed costs is the same at both points of activity. The change in the total costs is thus the variable cost rate multiplied by the change in the number of units of activity.