Capital Loss

Capital Loss

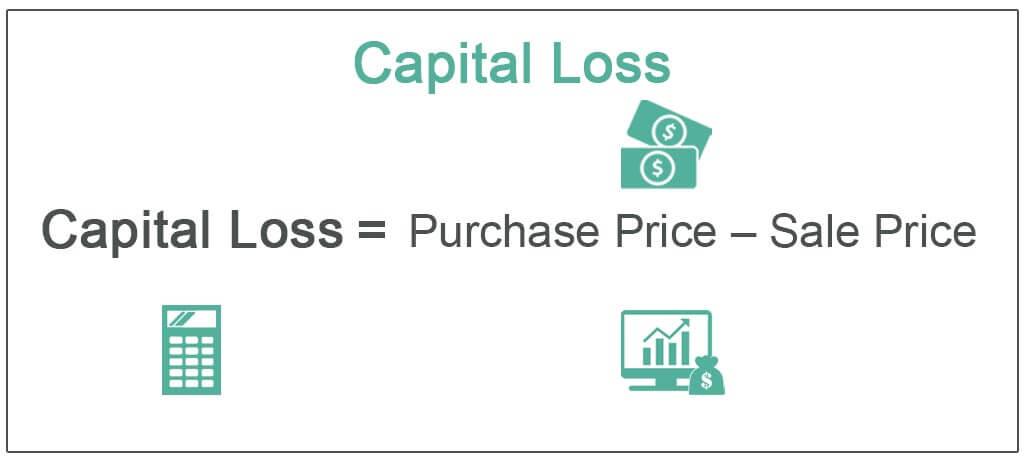

A capital loss is when the value decreases for a capital asset, such as an investment or real estate. This loss will not realise until the sold asset is for a price lower than the purchase price originally.

It is a difference between the purchase price and the selling price of the asset, where the selling price is lower than the purchase price.

Understanding a Capital Loss

For example, if an investor bought a house for $250,000. After he sold the house five years later for $200,000, the investor realizes a capital loss of $50,000.

For personal income tax, capital gains can be offset via capital losses. When a position liquidates a sale price that is less than the purchase price, taxable income does a reduction on a dollar-for-dollar basis. Net losses of more than $3,000 can carry over to the following tax year to offset gains or directly reduce taxable income. Substantial losses carry forward to subsequent years until the amount of the loss exhausts.

Reporting a Capital Loss

Capital losses and capital gains are reported on Form 8949, on which dates of sale determine whether those transactions constitute short- or long-term gains or losses. Short-term gains tax at ordinary income rates. Thus, short-term losses, match against short-term gains, benefit high-income earners who have realized profits by selling an asset within a year of purchase. Because their taxable income gets a reduction.

Carry Forward of Losses

Thankfully, if you are unable to recover the entire capital loss in the same year, you can carry forward both the short-term and long-term for eight assessment years immediately after the assessment year in which the loss was first measured. When capital losses occur from a company, these losses may be carried forward. It is not necessary to carry this onto the business.